How Many Hidden Billionaires Are There? Unveiling Secret Fortunes

It's a question that, you know, really sparks curiosity: just how many super-rich individuals, the ones with vast amounts of money, manage to keep their incredible wealth out of the public eye? This idea of "hidden" fortunes, it really captures the imagination, doesn't it? We often hear about the world's richest people, those who make the headlines with their enormous sums, but what about the others? The ones whose financial lives are, in a way, more private?

When we talk about "hidden" billionaires, we're not always talking about something illegal, you see. Sometimes, it's simply about privacy, about keeping one's financial dealings quiet for various reasons. It's a bit like asking "how many stars are in the sky?" The answer, honestly, is that it's a large but indefinite number, isn't it? We can guess, we can estimate, but getting a precise figure is, well, quite a challenge.

This pursuit of understanding the scope of unreported wealth is, in some respects, a fascinating one. It touches on so many aspects of our world, from economics to privacy, and even, you know, to how we define success. So, what does it mean for wealth to be "hidden," and why does it happen? Let's take a closer look, shall we?

Table of Contents

- Defining the "Hidden": What Does Unreported Wealth Mean?

- Why Some Fortunes Stay Out of Sight

- The Tools of Wealth Concealment

- Estimating the Unseen: Challenges and Approaches

- The Impact of Unreported Wealth on Society

- Frequently Asked Questions About Hidden Wealth

Defining the "Hidden": What Does Unreported Wealth Mean?

When we talk about "hidden" billionaires, it's important to, you know, get a good grasp on what that word "hidden" actually implies. It's not always about illegal activities, not at all. Often, it simply means that a person's financial worth isn't easily visible through public records or commonly tracked lists. This could be because their assets are held in complex structures, or perhaps they simply choose not to disclose their full financial picture.

The term "many" itself, as we know, refers to a large but indefinite number. So, asking "how many hidden billionaires are there?" is, in a way, asking about a number that we can't pin down exactly. It's a general word that refers to a large but indefinite number of units or individuals, you see. This makes counting them, well, quite difficult.

Unreported wealth, then, often means wealth that isn't transparently declared for public or, sometimes, even for tax purposes in a straightforward way. It might be perfectly legal, just, you know, not widely known. It's a bit like trying to count how many fish are in the ocean; you know there are many, but an exact count is pretty much impossible, isn't that right?

This kind of wealth can be held in various forms, making it, honestly, hard to track. It's not always cash under a mattress, not by a long shot. It's more often tied up in things like real estate, art, or businesses that aren't publicly traded. So, you can see why getting a precise figure for "how many hidden billionaires are there?" is, you know, a real puzzle.

Why Some Fortunes Stay Out of Sight

There are, you know, quite a few reasons why someone with a massive fortune might choose to keep it out of the public eye. It's not just one thing, but a combination of factors that, really, influence these decisions. These reasons often make a lot of sense from the individual's perspective, even if they contribute to the challenge of knowing "how many hidden billionaires are there."

Privacy and Personal Safety

For one thing, privacy is a huge motivator. When you have an immense amount of money, you, like your family, can become targets for all sorts of unwanted attention. This can range from constant requests for money to, sadly, more serious threats like kidnapping. So, keeping a low profile financially can, in a way, offer a layer of protection, you know?

Imagine, for a moment, having your every move, every purchase, every investment scrutinized. It's, honestly, a lot of pressure. For many wealthy individuals, maintaining a degree of anonymity is, therefore, a very personal choice for their own well-being and that of their loved ones. It just makes sense, doesn't it?

Tax Considerations

Another big reason, and this is pretty common, involves tax planning. Wealthy people often seek ways to manage their assets in a way that minimizes their tax obligations. This isn't always about evasion, which is illegal, but about using legal structures and strategies to reduce the amount of tax they owe. This is, you know, a complex area of finance.

These strategies can involve moving assets to jurisdictions with lower tax rates or using various financial instruments that offer tax advantages. It's a bit like, say, choosing the most efficient route for a long trip; you're still getting to your destination, but you're trying to do it in the most cost-effective way possible. This, naturally, contributes to wealth being less visible, making it harder to count "how many hidden billionaires are there."

Avoiding Public Scrutiny

Some billionaires, you know, just prefer to avoid the spotlight that comes with extreme wealth. Public opinion can be harsh, and the media often focuses on the lifestyles of the super-rich, sometimes with a critical eye. So, to sidestep this kind of attention, they might choose to keep their financial details private. It's, honestly, a way to live a more normal life, relatively speaking.

This can also be true for individuals who've accumulated wealth through less conventional means, or perhaps through industries that attract public criticism. By keeping their financial standing under wraps, they can, in a way, avoid uncomfortable questions or negative press. It's, basically, a strategic move for managing their public image.

Legacy and Succession Planning

Finally, there's the matter of legacy and succession. Many wealthy individuals are, you know, very focused on how their wealth will be managed and passed down through generations. Setting up complex trusts or foundations can help ensure that their fortune is preserved and distributed according to their wishes, often without public interference.

These structures can also protect assets from future legal challenges or family disputes. It's, honestly, about long-term planning, making sure that the wealth serves its intended purpose for many years to come. This kind of planning often involves a high degree of privacy, which, of course, means the wealth is less visible to the general public, adding to the mystery of "how many hidden billionaires are there."

The Tools of Wealth Concealment

So, how exactly do these vast fortunes stay out of sight? It's not, you know, some simple trick. It involves a sophisticated array of financial and legal tools that are designed to, in a way, obscure ownership and make tracking assets incredibly difficult. These are the mechanisms that contribute to the indefinite number of "how many hidden billionaires are there."

Offshore Accounts and Tax Havens

One of the most commonly discussed methods involves offshore accounts and tax havens. These are countries or jurisdictions that offer very low or no taxes, along with strict financial secrecy laws. By placing money or assets in banks or companies in these locations, individuals can, you know, shield their wealth from their home country's tax authorities and public view.

Places like the Cayman Islands, Panama, or Switzerland have, for a long time, been associated with this kind of financial activity. The idea is that the money is legally held there, but the identity of the true owner is, basically, kept confidential. This makes it very, very hard for anyone outside that jurisdiction to see who owns what, so it is.

Trusts and Foundations

Trusts and foundations are, you know, legal arrangements that allow someone to transfer assets to another entity for the benefit of specific individuals or purposes. The original owner, or "settlor," no longer directly owns the assets, but they are managed by a "trustee" or the foundation's board. This separation of ownership is, honestly, a key element.

These structures can be set up in a way that the beneficiaries' names are not publicly disclosed, or the assets are held for a very long time, sometimes even for generations. This provides a significant layer of privacy and protection from creditors or legal claims. It's, basically, a very flexible tool for long-term wealth management, and it certainly helps keep things private, you know.

Shell Companies

Shell companies are, in a way, companies that exist only on paper, without any real business operations or physical presence. Their main purpose is often to hold assets or facilitate financial transactions without revealing the identity of the true owner. They are, you know, often registered in jurisdictions with lax corporate transparency laws.

Imagine a series of nested dolls, where each doll is a company, and the smallest doll, the one in the middle, is where the actual owner's name might be. This layering makes it, honestly, incredibly difficult to trace the money back to the real person behind it. This is a very common method for wealth concealment, contributing significantly to the question of "how many hidden billionaires are there."

Complex Financial Instruments and Investments

Beyond traditional bank accounts, wealth can be hidden through complex financial instruments like derivatives, hedge funds, or private equity investments. These are often, you know, highly specialized and not easily understood by the average person, or even by many financial experts outside that specific field.

These investments can be structured in ways that obscure the beneficial owner, or they might involve private placements that aren't subject to public reporting requirements. It's, in a way, like putting your money into something that doesn't show up on any standard radar, making it, honestly, very hard to track. This kind of financial maneuvering is, basically, a big part of how wealth stays out of sight.

Tangible Assets

Sometimes, wealth isn't just in bank accounts or stocks. It can be, you know, tied up in tangible assets that are less liquid and harder to value publicly. Think about very expensive art collections, luxury real estate, yachts, or even vast tracts of land. These items can represent enormous wealth but don't always appear on public financial statements.

For example, a painting bought at a private auction or a mansion purchased through a shell company might never have the true owner's name publicly attached to it. These assets can be moved or traded privately, further obscuring their ownership and value. So, you know, it's not always about money in a bank, but things you can touch, too it's almost.

Estimating the Unseen: Challenges and Approaches

So, given all these methods for concealment, how do we even begin to answer "how many hidden billionaires are there?" The simple truth is, you know, we can't get an exact number. It's a bit like asking how many grains of sand are on a beach; you know there are many, but an exact count is impossible. The meaning of "many" is, after all, consisting of or amounting to a large but indefinite number.

Organizations that track global wealth, like Forbes or Bloomberg, usually rely on publicly available information: stock holdings, real estate records, company filings, and media reports. But for those who actively work to keep their wealth private, this information just isn't there. So, their lists are, basically, only a partial picture, aren't they?

Researchers and economists who try to estimate the scale of hidden wealth often use different approaches. Some might look at discrepancies in national accounts, comparing reported assets with known liabilities, or analyzing capital flows into tax havens. Others might use statistical models based on wealth distribution patterns in countries with more transparent data. These are, you know, very complex calculations.

However, these methods provide, honestly, only estimates, not precise figures. They can tell us that the amount of hidden wealth is likely very substantial, perhaps trillions of dollars globally, but they can't give us a definitive count of individuals. It's a bit like trying to measure the wind; you can see its effects, but you can't hold it in your hand, can you?

The very nature of "hidden" means it's designed to be uncounted. As "My text" points out, "many is a general word that refers to a large but indefinite number of units or individuals." This perfectly describes the challenge here. We know there are many, a large number, but the specific count remains, you know, a mystery. This makes any answer to "how many hidden billionaires are there?" always an approximation, at best.

There are, you know, ongoing efforts by international bodies and governments to increase financial transparency and crack down on illegal wealth concealment. Initiatives like the Common Reporting Standard (CRS) aim to make it harder for individuals to hide assets in offshore accounts without their home country's knowledge. But even with these efforts, the landscape is, honestly, constantly shifting.

The more sophisticated the methods of tracking become, the more sophisticated the methods of concealment also tend to become. It's, in a way, an ongoing game of cat and mouse. So, while we can say with certainty that there are "many" hidden billionaires, the exact figure will, basically, always remain elusive, you know, a secret held close by those who possess such vast sums.

The Impact of Unreported Wealth on Society

The existence of a significant amount of unreported wealth, and thus, you know, a large but indefinite number of hidden billionaires, has some pretty big implications for society as a whole. It's not just a curiosity; it affects things like fairness and the way our economies work. So, understanding this phenomenon is, honestly, quite important.

One major concern is wealth inequality. When a considerable portion of global wealth is concentrated in the hands of a few, and much of that is not publicly visible, it can skew our perception of who has what. This can, in a way, make the gap between the rich and everyone else seem even wider, or perhaps, less understood than it truly is. It's, basically, a contributing factor to discussions about economic disparity.

Another point is the impact on government revenues. If wealth is successfully hidden, it often means that the taxes on that wealth are not being fully collected. This can lead to governments having less money for public services like education, healthcare, or infrastructure. It's, honestly, a drain on the public purse, isn't it?

Moreover, the use of complex structures for wealth concealment can sometimes facilitate illicit activities, even if that's not the primary intent for every hidden billionaire. Things like money laundering or financing illegal operations can, you know, piggyback on the same systems designed for privacy. This creates a challenge for law enforcement and regulators, too it's almost.

Ultimately, the presence of so much hidden wealth can erode public trust in financial systems and institutions. When people perceive that the rules are different for the very rich, it can lead to feelings of unfairness and cynicism. This is, you know, a significant social concern that, really, impacts everyone, not just those with fortunes. Learn more about wealth transparency on our site.

It also makes it harder to get a true picture of the global economy. If a large chunk of assets is moving in the shadows, it's difficult for economists and policymakers to make accurate assessments and plan effectively. This lack of transparency can, in a way, create blind spots in our understanding of financial flows and risks. It's, basically, a challenge for sound economic management, you know, and it's something that is, honestly, a big topic in financial circles today. You can also explore global economic trends for more information.

Frequently Asked Questions About Hidden Wealth

Why do billionaires hide their wealth?

Billionaires often choose to keep their wealth private for several reasons, you know. A big one is personal privacy and safety, as public knowledge of immense wealth can attract unwanted attention or even threats. Another significant factor is tax planning, using legal methods to reduce tax obligations. They might also want to avoid public scrutiny and negative media attention that often comes with extreme wealth. Finally, some do it for legacy and succession planning, ensuring their fortune is managed and passed down according to their wishes without public interference, so it is.

How do people hide their money?

People use a variety of sophisticated methods to hide their money, you see. Common approaches include setting up offshore accounts in jurisdictions with strong secrecy laws and low taxes. They also use complex legal structures like trusts and foundations, which separate ownership from control and can obscure the true beneficiaries. Shell companies, which are companies with no real operations, are often used to hold assets or facilitate transactions without revealing the owner's identity. Additionally, investing in complex financial instruments or tangible assets like art and real estate, often through these structures, helps keep wealth out of public view, you know, making it very hard to trace.

Is it illegal to hide wealth?

It's important to understand that simply keeping wealth private is not, by itself, illegal, you know. Many legal strategies exist for wealth management that also offer privacy. However, it becomes illegal when wealth is hidden to evade taxes, launder money from criminal activities, or finance terrorism. This is called tax evasion or illicit financial flows. The line between legal privacy and illegal concealment can, honestly, be quite fine and depends on the specific laws of the countries involved and the intent behind the actions. So, it's not always a clear-cut answer, is it?

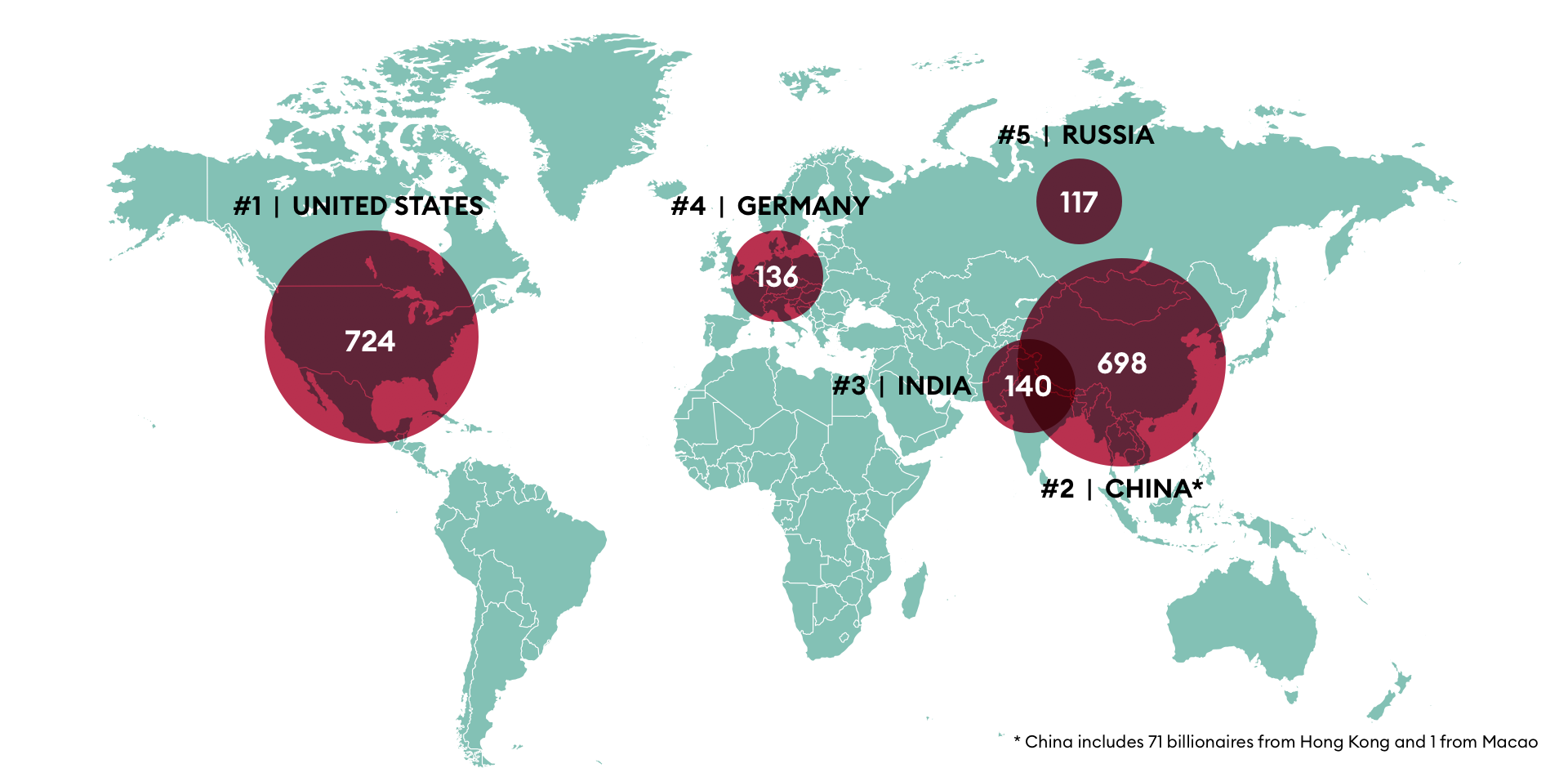

Forbes Billionaires 2020

How Many Billionaires Are There In The Us 2024 - Rena Valina

This Map Shows Where the World’s Billionaires Got Their Money