Did Magellan Get Bought Out? Unpacking Recent Company Acquisitions

Have you, like many others, found yourself wondering, "Did Magellan get bought out?" It's a question that, frankly, pops up quite a bit, especially when you consider the sheer volume of business news floating around these days. You might have heard whispers or seen headlines, and it's easy to feel a little confused about what really happened with a name like Magellan, which, you know, sounds pretty significant.

The truth is, there isn't just one single "Magellan" company out there, and that's where a lot of the mix-up comes from. In fact, there have been a few big moves involving different entities bearing the Magellan name in recent times. So, when someone asks about Magellan being acquired, it's actually a pretty good idea to ask back, "Which Magellan are you thinking about?"

This article will help clear up that very question, giving you a clearer picture of what's been happening in the corporate world with these distinct businesses. We'll look at the specific companies, who decided to bring them into their fold, and what these changes mean for the industries they operate in. It's really quite interesting, in a way, to see how these big deals shape things for all of us.

Table of Contents

- The Question of "Magellan": More Than One Company?

- Why These Deals Matter

- Frequently Asked Questions About Magellan Acquisitions

- Looking Ahead

The Question of "Magellan": More Than One Company?

When people ask, "Did Magellan get bought out?", it's almost like they're picturing a single, big ship sailing off into the sunset with a new flag. But the reality is a bit more like a fleet of ships, each with its own journey. There isn't just one company named Magellan that everyone talks about. Instead, there are distinct businesses, each operating in very different sectors, that have recently seen significant ownership changes. This distinction is pretty important for making sense of the news, as a matter of fact.

We're talking about three main entities here: Magellan Health, Magellan Rx Management, and Magellan Midstream Partners. Each one has a unique story regarding its recent acquisition, involving different buyers and different reasons for the deals. So, to give you a clear answer, we need to look at each one individually, which is exactly what we're going to do. You'll see, it's not as simple as a yes or no.

Magellan Health: A New Chapter with Centene

Let's start with Magellan Health, Inc. This company, often referred to by its ticker symbol MGLN, has indeed been acquired. It was Centene Corporation, known as CNC, that stepped up to complete this significant purchase. The news of Centene completing its acquisition of Magellan Health, Inc. was a big headline in the healthcare world, as you can imagine. This kind of move typically reshapes services for a lot of people.

The definitive merger agreement between Centene and Magellan Health, Inc. was a major step for both organizations. While the provided text doesn't give us the exact financial details of this particular deal, the completion of such an acquisition usually means a shift in how healthcare services are managed and delivered. It's about bringing together different strengths, so to speak, to serve a wider population or improve existing offerings. This sort of thing can, in some respects, alter the very landscape of patient care.

The process for deals of this size often involves a lot of planning and approvals, which can take quite a bit of time. When Centene announced the completion, it marked the end of one era for Magellan Health and the beginning of another under a larger corporate umbrella. This really means that if you're looking for Magellan Health, it's now part of the Centene family, which is a pretty big change, if you think about it.

Magellan Rx Management: Joining Prime Therapeutics

Next up, we have Magellan Rx Management. This entity is quite distinct from Magellan Health, focusing specifically on pharmacy solutions. Prime Therapeutics officially acquired Magellan Rx Management, which was a rather notable event in the specialty pharmacy space. This acquisition, announced back in May 2022, was valued at a cool $1.35 billion, which is, honestly, a significant sum of money.

Magellan Rx is known for its comprehensive pharmacy solutions, including leading capabilities in managing specialty drugs, handling Medicaid administration, and offering broad pharmacy benefits management. So, when Prime Therapeutics decided to bring Magellan Rx into its fold, it was a move designed to enhance its own suite of pharmacy benefit management tools. This means, essentially, that Prime Therapeutics wanted to beef up its offerings, especially in areas where Magellan Rx truly excelled.

The idea behind this particular acquisition was to combine expertise in pharmacy and medical drug management. The goal, as stated, was to create opportunities to transform the industry by driving affordability. This kind of integration, you know, can really make a difference in how medications are accessed and how much they cost for people. It's about creating a more comprehensive approach to managing drug costs and patient care, which is, obviously, a big deal for everyone involved in healthcare.

Magellan Midstream Partners: Becoming Part of Oneok

Finally, we come to Magellan Midstream Partners, often seen as MMP. This company operates in a completely different sector: energy infrastructure. Oneok Inc., or OKE, is the company that agreed to acquire Magellan Midstream Partners in a substantial cash and stock deal. This transaction was valued at approximately $18.8 billion, including assumed debt, making it a truly massive corporate event, really.

The unitholders of Magellan Midstream Partners had their say, and they voted in favor of the sale to Oneok Inc., their larger rival. This agreement was finalized, creating what the reports suggest is one of the largest U.S. pipeline infrastructures. Oneok's acquisition adds refined products and crude oil transportation assets to its existing natural gas and natural gas liquids (NGL) portfolio. This means, pretty much, a huge expansion of their network.

With this deal, Oneok's pipeline infrastructure now stretches over 50,000 miles, creating a vast connection across the country. The integration of Magellan Midstream Partners' assets with Oneok's existing network is a strategic move to broaden their reach and capabilities in energy transportation. This kind of consolidation, you know, can have wide-ranging effects on how energy products are moved across the nation, potentially streamlining processes and increasing efficiency. It's a very significant development for the energy sector, in a way.

Why These Deals Matter

Understanding that different "Magellan" entities were acquired by different companies is key. But beyond just knowing who bought whom, it's important to grasp why these deals are so impactful. These aren't just paper transactions; they represent strategic shifts that can affect industries, services, and even everyday life for many people. It's, like, a big ripple effect, essentially.

Each acquisition has its own set of reasons and expected outcomes, tailored to the specific industry it belongs to. Whether it's healthcare or energy, these mergers are about creating new synergies, expanding market presence, or achieving greater operational efficiency. They're about, you know, reshaping the competitive landscape and aiming for long-term growth. So, let's consider what some of these bigger implications might be.

Shaping the Healthcare Landscape

The acquisitions involving Magellan Health and Magellan Rx Management are particularly significant for the healthcare sector. When Centene acquired Magellan Health, it brought together two large entities in the health services space. This kind of combination can lead to a more integrated approach to patient care, potentially offering a broader range of services under one umbrella. It's about making care more coordinated, which is, arguably, something many patients could benefit from.

Similarly, Prime Therapeutics' acquisition of Magellan Rx Management is all about enhancing pharmacy benefit management. By combining their strengths, these companies aim to improve how specialty drugs are managed and how pharmacy benefits are administered. The stated goal of driving affordability is, of course, a major one, given the rising costs of medications. This move could, in theory, lead to more streamlined processes for getting necessary drugs to people and managing the associated expenses. It's a pretty big step towards, you know, better drug management.

These healthcare mergers are often driven by a desire to gain a competitive edge, expand service offerings, and, ideally, improve patient outcomes. They reflect a trend towards larger, more comprehensive healthcare organizations that can offer a wider array of services, from mental health support to pharmacy benefits. The idea is to create a more unified system, which can be a real challenge but also offer real advantages for patients and providers alike, in some respects.

Impact on Energy Infrastructure

The acquisition of Magellan Midstream Partners by Oneok Inc. tells a different but equally important story, this time in the energy sector. This deal creates a truly massive network of pipelines, combining crude oil and refined products transportation with natural gas and NGL capabilities. This is, you know, a huge expansion of infrastructure that plays a vital role in moving energy resources across the country. It's about connecting supply to demand on a very large scale.

The integration of these extensive pipeline systems can lead to greater efficiency in energy transportation. A larger, more connected network might reduce bottlenecks and allow for more flexible delivery of fuels and other energy products. This kind of consolidation in the midstream sector is about optimizing operations and ensuring a steady flow of resources. It's, literally, about powering homes and businesses across the nation, so the implications are pretty far-reaching.

Such large-scale infrastructure mergers are often about achieving economies of scale and creating a more resilient supply chain. By bringing together over 50,000 miles of pipeline, Oneok is positioning itself as a major player in U.S. energy transportation. This kind of strategic move can impact everything from fuel prices to energy security, which, honestly, affects everyone. It's a testament to the ongoing evolution of the energy industry, as a matter of fact.

Frequently Asked Questions About Magellan Acquisitions

It's natural to have more questions when you hear about big company changes. Here are some common inquiries people often have about the Magellan acquisitions:

Is Magellan Health still in business?

Yes, Magellan Health, Inc. is still operating, but it is now part of Centene Corporation. So, while the name "Magellan Health" might still be used for certain services or divisions, the company itself is now under the ownership of Centene. It's a bit like a brand becoming part of a larger family, you know, continuing its work but with new backing.

Who acquired Magellan Rx?

Magellan Rx Management was acquired by Prime Therapeutics. This acquisition was officially completed, bringing Magellan Rx's specialty drug management and pharmacy benefit management capabilities into Prime Therapeutics' offerings. It was a deal aimed at strengthening Prime Therapeutics' position in the pharmacy solutions space, which is, obviously, a big deal for them.

What is the Oneok Magellan deal about?

The Oneok Magellan deal refers to Oneok Inc.'s acquisition of Magellan Midstream Partners. This significant transaction, valued at approximately $18.8 billion, combines the pipeline assets of both companies, creating one of the largest energy transportation networks in the U.S. It's about expanding infrastructure for crude oil, refined products, natural gas, and NGLs, basically ensuring a more robust energy supply chain.

Looking Ahead

The corporate landscape is always shifting, and these Magellan acquisitions are just a few examples of how companies adapt and grow. The stories of Magellan Health joining Centene, Magellan Rx Management becoming part of Prime Therapeutics, and Magellan Midstream Partners integrating with Oneok highlight the strategic maneuvers businesses make to enhance their capabilities and market presence. It's a constant process of change and adaptation, which is, you know, pretty typical in the business world.

These mergers and acquisitions often take several years to fully integrate, with phases that can overlap as the new entities work to combine their operations, systems, and teams. The goal is always to create a stronger, more efficient organization that can better serve its customers or stakeholders. It's about building for the future, so to speak, and ensuring long-term viability in competitive markets. For more on how these large-scale business shifts happen, you can often find detailed reports from reputable financial news sources. Learn more about business mergers on our site, and perhaps link to this page understanding corporate acquisitions for further reading.

Staying informed about these kinds of corporate developments can give you a clearer picture of the broader economic trends and how different industries are evolving. It's a fascinating area to keep an eye on, really, as these changes often have a ripple effect far beyond the boardrooms where they are decided. So, keeping up with these kinds of stories is, arguably, a good way to stay connected to what's happening in the world of business and how it might just impact your own life, too.

- What Does It Mean When A Guy Calls You A Snow Bunny

- What Does Piccolo Mean In Namekian

- Can Spiders Leave Their Fangs In You

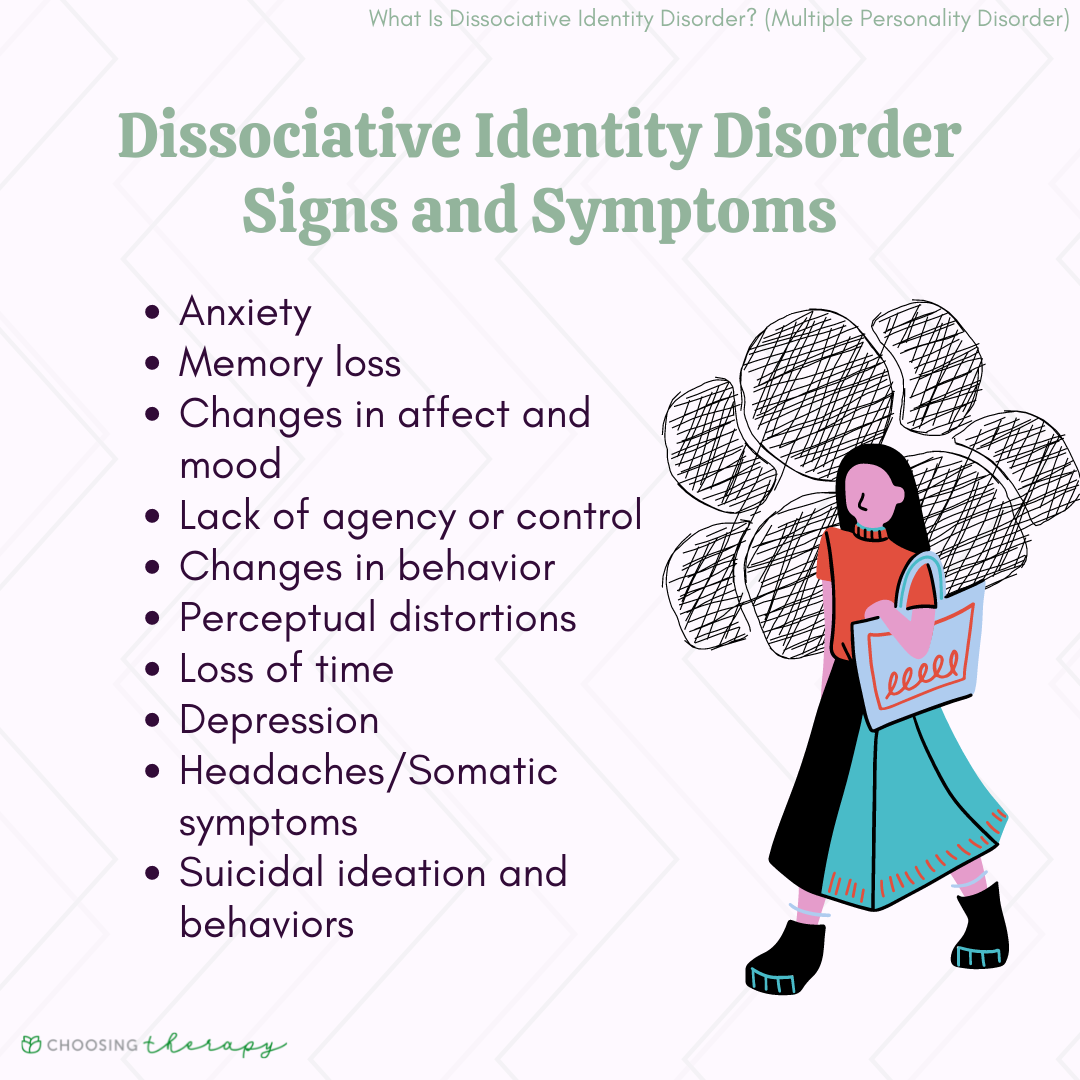

Dissociative Identity Disorder (DID): Symptoms, Causes, & Treatments

Dissociative Identity Disorder (DID): Symptoms, Causes, & Treatments

Como Se Usa El Verbo Auxiliar Do - Catalog Library